how to reduce taxable income for high earners australia

1 day agoAmong the top 10 high-income earners surgeons lawyers CEOs and miners took the greatest pay checks. One way to reduce your taxable income is to donate to a DRG organisation.

Inequality Measurement And Tax Transfer Policy Springerlink

Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

. If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket. Both health spending accounts and. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits.

Those who contributed the most to trust funds made. Invest in an investment bond to minimise your taxable income. Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO.

Hold investments in a discretionary family trust for tax-effective income distribution. High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. Keep Accurate Tax and Financial Records.

15 Easy Ways to Reduce Your Taxable Income in Australia 1. 50 best ways to reduce taxes for high income earners 1. In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time.

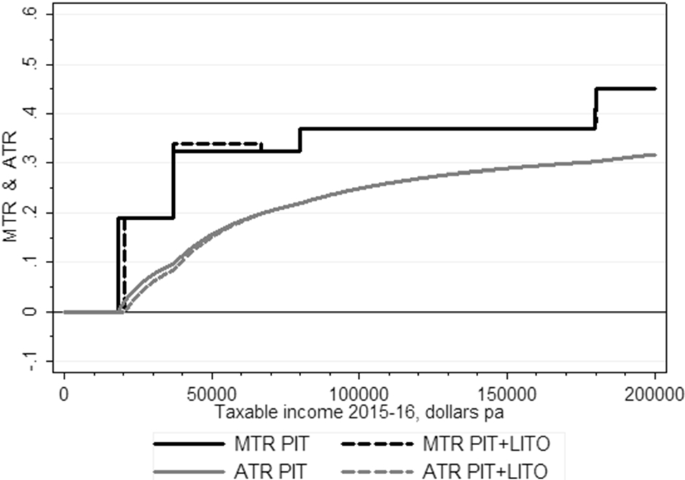

How to Reduce Taxable Income Through Charitable Donations. For taxable income levels between 180000 and 273000 the tax saving will be 34. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions.

An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account IRA. 50 Best Ways to Reduce Taxes for High Income Earners. There are many strategies to help you maximize your charitable contributions and reduce your income tax.

How Can A High Earner Reduce Taxable Income In Australia. Use your Franking Credits wisely to reduce taxes. Even worse high income earners are working Monday Tuesday and some of Wednesday just to pay the tax man.

Use of Franking Credits in your tax planning can save you tax. Most of our sydney clients are in the top 15 of earners in australia. You are allowed to claim a tax deduction depending on the type of donation.

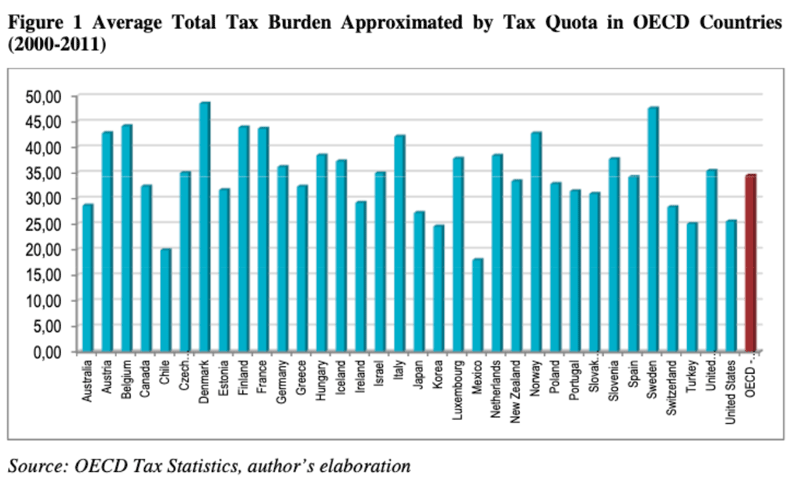

According to Australian government statistics Australian men earned 55829 in taxable income in 2018-19 whereas women made 40547. For every dollar you earn youre giving up nearly half to the tax man. According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners.

For those trying to learn how to save tax in Australia salary sacrificing is one way to do. Even with COVID and the incentives provided by the Australian government there are still genuine concerns from high-income earners and their taxable income because tax laws make it so that high-income earners get taxed at the highest rates. Tax deduction versus tax offset The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense.

You are just taking advantage of some price fluctuations to lower your tax bill. Consider salary sacrificing to reduce your taxable income. Buying a new desk to use at home could also be a work-related expense particularly during COVID.

The amount of offsets you get from your taxes Having a smaller capital gains tax CGT liability. Make spousal contributions to reduce your tax liability. 12 Tax Gain Harvesting.

For example if you were an entertainment reporter you may be able to claim the cost of tickets to events. Taxable investing accounts can be very tax-efficient for these folks. When you make a concessional contribution into your super account however you only pay a.

If you are a high-income earner it is sensible to implement tax minimisation strategies. Many people dont realize this but below a taxable income of 40400 80800 married you dont pay taxes on long term capital gains or qualified dividends for that matter. The contribution you will make will come straight out of your paycheck before its taxed and the money goes tax-free into the 401k or 403b.

A DRG deductible gift recipient is an ATO recognised organisation or fund that can receive tax-deductible gifts. High-earners using trust funds to reduce taxable income Australia Institute finds. For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19.

This is achieved by utilising the tax paid by the company which is passed on to the shareholder when a Franked Dividend is paid. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Some things crossover between work and life.

The ATO is far more likely to ask a lot of questions about your tax. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Because of the way Australias income tax system is structured moving.

AAP revealed a vast difference in earnings among women and men of a certain age. According to the ATO youre classified as a higher income earner if you earn over 180000 a year. A discretionary trust would be used for distributing business profits investments.

Forty-five of those millionaires were able to reduce their taxable income down to below the tax-free threshold of. Its never too late to focus on tax deduction strategies that can result in you paying fewer taxes. Negatively gear your investment property to reduce your taxable income.

For taxable income levels between 180000 and 273000 the tax saving will be 34. Some of Australias highest earners pay no tax and it costs them a fortune. Take Home Rates for an annual income of 400000.

How do high income earners reduce tax in Australia. The taking care of your partners assets. Most of our Sydney clients are in the top 15 of earners in Australia.

Effective tax planning with a qualified accountanttax specialist can help you to do that. These penalties can range from fines to imprisonment for more. High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions.

Franking credits can reduce the income tax paid on dividends or potentially be received as a tax refund. Tax deductions you may want to maximize. High Income Financial Planning Reduce Tax and Build Wealth.

The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

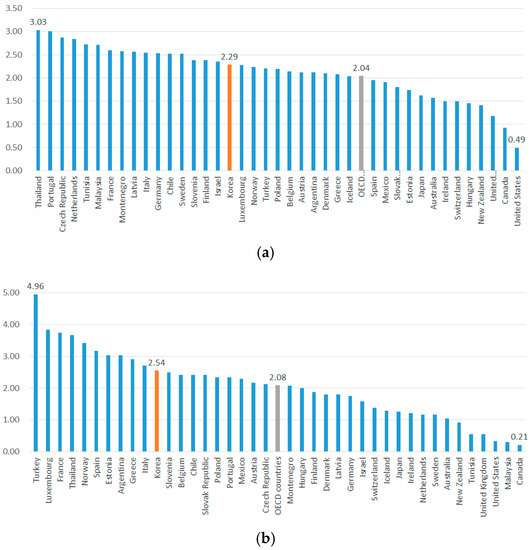

Measuring The Redistributive Capacity Of Tax Policies In Imf Working Papers Volume 2021 Issue 252 2021

Central African Economic And Monetary Community Cemac Selected Issues In Imf Staff Country Reports Volume 2019 Issue 002 2019

How To Reduce Your Income Tax In Australia Ictsd Org

How To Reduce Your Income Tax In Australia Ictsd Org

How To Reduce Your Income Tax In Australia Ictsd Org

The Role Of Policy And Institutions The Future For Low Educated Workers In Belgium Oecd Ilibrary

Sustainability Free Full Text Identifying Factors Reinforcing Robotization Interactive Forces Of Employment Working Hour And Wage Html

How To Reduce Your Income Tax In Australia Ictsd Org

Ireland Selected Issues In Imf Staff Country Reports Volume 2012 Issue 265 2012

How To Reduce Your Income Tax In Australia Ictsd Org

Ireland Selected Issues In Imf Staff Country Reports Volume 2012 Issue 265 2012

Ireland Selected Issues In Imf Staff Country Reports Volume 2012 Issue 265 2012

Measuring The Redistributive Capacity Of Tax Policies In Imf Working Papers Volume 2021 Issue 252 2021